Actually, a large part is ruined due to lack of proper processing of crops. This is the reason that the government has launched several schemes to promote the food processing sector, one of which is the important scheme, The Prime Minister Formalization of Micro Food Processing Enterprises (PMFME). Farmers can take benefit of this scheme by Apply PMFME loan.

So, if you are a farmer and want to Apply PMFME loan then you came to the right place. Here we discuss about Prime Minister Formalization of Micro Food Processing Enterprises (PMFME). Please read the full article.

What is PMFME loan?

The PMFME loan is a government scheme that provides financial assistance to small food processing units. Its purpose is to reduce the expenses incurred in establishing, upgrading and running these units.

The government also gives subsidy on the loan received under this scheme, which reduces the interest rate and reduces the burden of entrepreneurs.

The PMFME loan is a government scheme aimed at providing financial assistance to micro -food processing entrepreneurs.

Under this scheme, the government provides credit-linked capital subsidy and seed capital to entrepreneurs.

What is Credit-Linked Capital subsidy?

Under Credit-Linked Capital subsidy, the government subsidize a part of the loan taken by entrepreneurs. The percentage of subsidy depends on the cost of the project and type of entrepreneur.

For example, the subsidy project for individual micro entrepreneurs can be up to 35% of the cost, while for self -help groups (SHG) it can be up to 50%. The maximum amount of subsidy is Rs 10 lakh.

Also read: How to Apply ration card online?

What is Seed Capital?

Seed capital is a grant that the government gives to members of self -help groups (SHG). This grant can be used to buy working capital and small equipment. The amount of seed capital can be up to Rs 40,000 per member.

Benefits of PMFME loan

Low interest rate: The government gives subsidy of up to 35% on the loan received under this scheme, which reduces the interest rate significantly from the bank’s general interest rate.

High loan amount: Under this scheme, a loan of up to Rs 10 lakh can be taken.

Flexible withdrawal period: A maximum of 10 years time is given for the return of the loan, including a moretorium from 6 months to 2 years.

No bail required: There is no need to mortgage any property to take a loan under this scheme.

Used for various expenses: This loan can be used for various expenses, such as purchasing machinery and equipment, buying raw materials, preparing infrastructure etc.

Who can apply for PMFME loan?

- Individual micro -food processing units (proprietorship, partnership)

- Farmer producing organization (FPO)

- Self -help group (SHG)

- NGO (NGO)

- Co -operatives

- Private Limited Companies

Which products are applied to PMFME loan?

This scheme applies to various types of food processing products, including:

- Grain processing (flour mill, dal mill, etc.)

- Fruit and vegetable processing (jam, jelly, pickle, canned foods, etc.)

- Milk and dairy product processing (cheese, butter, ghee, etc.)

- Meat and fish processing (meat products, fish products, etc.)

- Spices and Masala Products Processing

- Bakery and confectionery product processing

- Soft beverages and juice processing

- Other food processing products (papad, salty, chutney, etc.)

Documents required to get PMFME loan

To get PMFME loan, you have to submit the following documents:

- Application form: Application form in prescribed format

- Identity Card: Aadhaar card, voter ID card, driving license, passport, etc.

- Residence Certificate: Ration card, electricity bill, water bill, etc.

- Income Certificate: Income tax return, bank statement, etc.

- Trade Plan: Trade Plan for Food Processing Unit

- Financial Description: Financial Description of Food Processing Unit

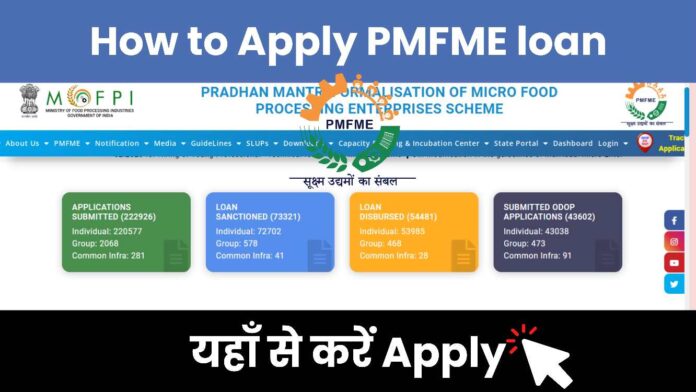

How to Apply PMFME loan?

You can follow the following steps to apply for PMFME loan:

- Get information about the scheme: For detailed information about PMFME scheme, you can visit the official website https://pmfme.mofpi.gov.in.

- Contact the Food Processing Department or District Industries Center of your district: Get the application form for PMFME loan at the Food Processing Department or District Industries Center of your district.

- Fill the application form: Fill the application form carefully and attach all the necessary documents.

- Submit the application form to the concerned bank: submit the application form to the concerned bank.

How to apply under Online PM FME Scheme

Application Process

- Go to the official website of PM FME scheme.

- On the homepage, click on “online registration”.

- Sign up.

- Fill the following information in registration form:

- Beneficiary type

- Name

- email id

- mobile number

- Address

- State

- District

- Click “Register”.

How to login applicant

- Go to the official website of PM FME scheme.

- On the homepage, click “Login”.

- Click “Applicant Login”.

- On the login page, select your beneficiary type.

- Enter the user ID and password.

- Click “Submit”.

The PMFME scheme is an important initiative that can help promote the unorganized food processing sector. The scheme can help small food processing enterprises to grow and develop their business, and this will improve the overall economic situation of the country.